What QE Actually Impacted by Eric Bush, CFA, Gavekal Capital Blog

The Federal Reserve's balance sheet has now been relatively unchanged for about 10 months. Total asset at the Fed are about $61 billion higher than they were one year ago. It sounds like a lot but considering total assets are currently $4.48 trillion, $61 billion is a drop in the bucket.

During the various QE programs in the US, a useful template to track different market and economic indicators was to plot them against the 3-month change in total Fed assets (see some of our older posts here, here, and here). Now that we have gone nearly a year since the taper ended, let's check in on some relationships.

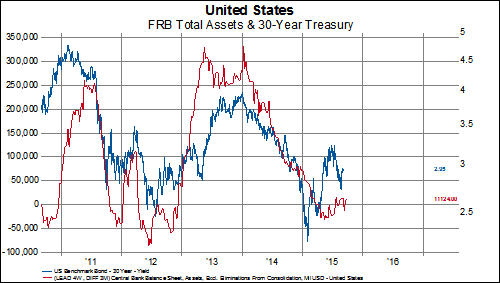

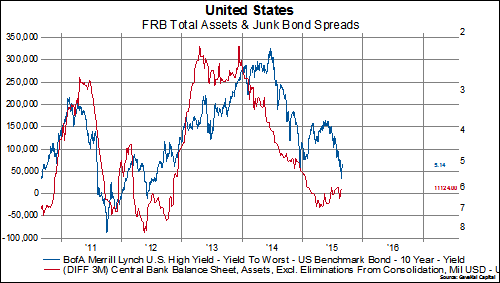

QE certainly affected asset prices. For government bonds, yields widened as the Fed's balance sheet expanded and have narrowed as the Fed's balance sheet has stopped growing. For corporate bonds, spreads over treasury narrowed as the Fed was expanding its balance sheet and have since widened substantially as the Fed's balance sheet has stopped expanding. Breakeven inflation expectations have dropped significantly as the Fed's balance sheet has stopped growing as well.

Stocks were positively affected as well. The 12-month change in the S&P 500 has fairly closely tracked the 3-month change in Fed assets. Momentum in the market has also tracked the change in Fed assets.

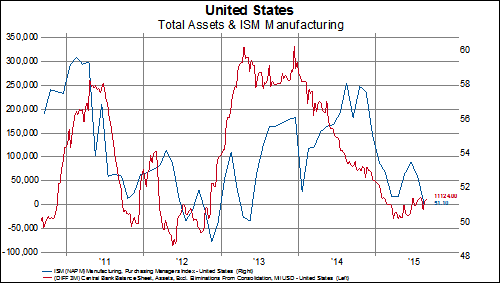

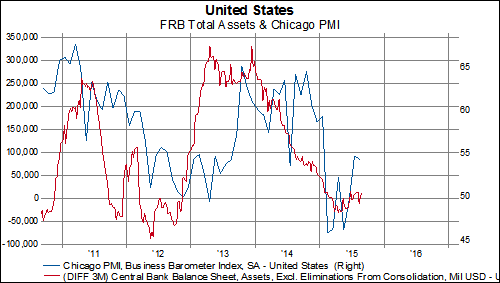

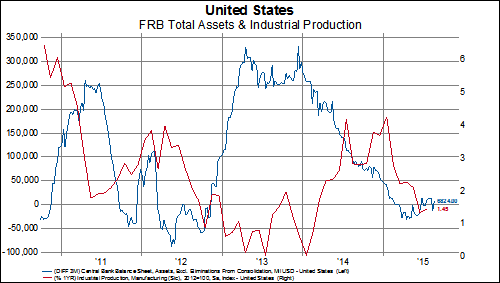

The effect on economic indicators is much more mixed. QE seems to have clearly impacted the manufacturing PMIs. However, the effect on manufacturing IP itself is tougher to discern.

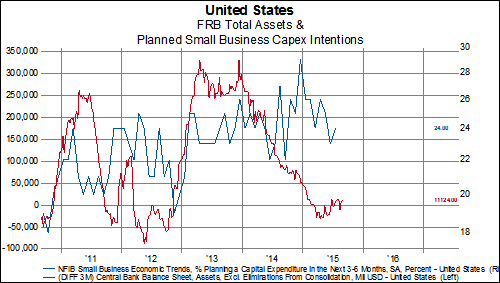

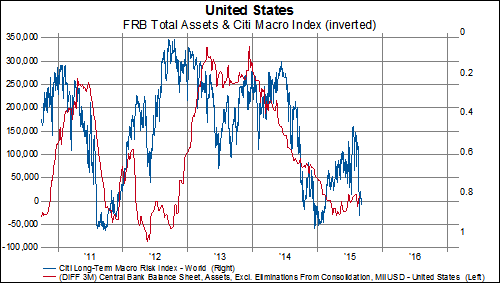

It's tough to see if QE had much effect on house prices. And it certainly didn't matter to the consumer or small business owners. However, it seems to have negatively impacted economic surprises and increased perceived macro risks in the world as it was winding down.

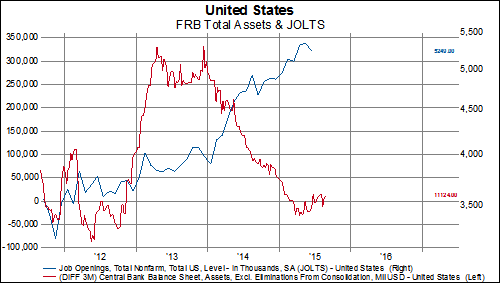

Finally, QE didn't seem to make much of a difference for nominal GDP or employment.

Unfortunately, overall it seems that QE had a much larger impact on bond and stock prices than on real economic activity. Government bond yields widened when the Fed was expanding its balance sheet while corporate spreads over bond yields narrowed. Stock prices were positively impacted by QE as well and have lost a lot of momentum since QE ended. Manufacturing surveys, in the US and globally, have been affected by QE but real economic indicators such as employment, small business intentions, and GDP have shown little relationship to changes in the Fed's balance sheet level.

The post What QE Actually Impacted appeared first on ValueWalk.

Sent from my iPad

No comments:

Post a Comment