Value investing in India, applying principles of Buffett, Phil Fischer and other great investors. An attempt to discover undervalued stocks that can generate above average returns combining fundamental and technical analysis

Sunday, December 20, 2015

Saturday, December 19, 2015

Sunday, December 13, 2015

Business Operator Vs Investor

C being a business operator was stressing on 1) opening one's mind to exponential growth 2) being agnostic to nature of the business product/service and 3) optimism to drive investing. It is interesting to see Infosys's case study in that context:

Infosys was founded in 81 and after the first 10 years they reached a turnover of INR 8 Crores - For an investor sitting in 92, it could have meant two things: 1) IT services space is not scalable or 2) the company could not grow because of external factors. C would have written off the company based on their inability to scale in a decade of existence.

Come March 1992, Founders were set on the path of listing the company after a decade of its existence. It is interesting to see that they set a target of reaching $ 100 MM (INR 250 crores) in revenue by 2000. This is 30 times the growth they achieved in the previous decade - It would have been tough for C or me to believe the growth expectations given the company's track record. In 1993, the company showed first signs of growth acceleration with revenues showing over 50% growth but nothing to ride home given the small base. On expected lines, it was tough to see the IPO sail thru primarily because it was a new industry and possibly because growth expectations were too rosy despite pricing at the issue at a TTM P/E of 13 x. This is where my investor hat might have helped, given that the company was priced moderately for the growth it was demonstrating including some confidence in mgmt's execution abilities, not their forecasting abilities. What they delivered over the next 8 years would have debunked both C's and my wildest forecasts.

Here's a case (and mostly in almost all other cases) where India's best ever company was in the making and I would have completely missed the bus if I'd used the business operator's lenses. It appears that growth at reasonable prices and fear of the unknown are investor's good friends. No wonder, business owners often miss predicting cycle changes because they have to be optimistic and gun for the jugular in all conditions. Same thing cannot be said about an investor, it perhaps pays to be cautious and follow Munger's maxim - " Tell me where I'm going to die and I won't go there"

Tuesday, December 8, 2015

Price declines and investor psychology

prices of stocks we own as an opportunity to acquire even more of a good thing at a better price.”

[S]mile when you read a headline that says ‘Investors lose as market falls.’ Edit it in your mind to

‘Disinvestors lose as market falls but investors gain

We never take [one-year figures] very seriously. After all, why should the time required for a planet to circle the sun synchronize precisely with the time required for business actions to pay off

Wednesday, December 2, 2015

Book of Simple Living - Ruskin Bond

When all the wars are done, an ant will still be beautiful

Some of the best sounds are made by water

Good company on the road is the shortest cut

One sure way to lose the world is trying to grasp everything in it!

The world is the size of each man's head

If you want something very badly, don't try too hard, don't pursue - better still, don't want it badly

Sunday, November 29, 2015

The myth of the teen brain

The Myth of the Teen Brain [Preview]

Its not only in newspaper headlines--its even on magazine covers. TIME, U.S. News & World Report and even Scientific American Mind have all run cover stories proclaiming that an incompletely developed brain accounts for the emotional problems and irresponsible behavior of teenagers. The assertion is driven by various studies of brain activity and anatomy in teens. Imaging studies sometimes show, for example, that teens and adults use their brains somewhat differently when performing certain tasks.

As a longtime researcher in psychology and a sometime teacher of courses on research methods and statistics, I have become increasingly concerned about how such studies are being interpreted. Although imaging technology has shed interesting new light on brain activity, it is dangerous to presume that snapshots of activity in certain regions of the brain necessarily provide useful information about the causes of thought, feeling and behavior.

Automatically assuming that the brain causes behavior is problematic because we know that an individuals genes and environmental history--and even his or her own behavior--mold the brain over time. There is clear evidence that any unique features that may exist in the brains of teens--to the limited extent that such features exist--are the result of social influences rather than the cause of teen turmoil. As you will see, a careful look at relevant data shows that the teen brain we read about in the headlines--the immature brain that supposedly causes teen problems--is nothing more than a myth.

Cultural Considerations

The teen brain fits conveniently into a larger myth, namely, that teens are inherently incompetent and irresponsible. Psychologist G. Stanley Hall launched this myth in 1904 with the publication of his landmark two-volume book Adolescence. Hall was misled both by the turmoil of his times and by a popular theory from biology that later proved faulty. He witnessed an exploding industrial revolution and massive immigration that put hundreds of thousands of young people onto the streets of Americas burgeoning cities. Hall never looked beyond those streets in formulating his theories about teens, in part because he believed in "recapitulation"--a theory from biology that asserted that individual development (ontogeny) mimicked evolutionary development (phylogeny). To Hall, adolescence was the necessary and inevitable reenactment of a "savage, pigmoid" stage of human evolution. By the 1930s recapitulation theory was completely discredited in biology, but some psychologists and the general public never got the message. Many still believe, consistent with Halls assertion, that teen turmoil is an inevitable part of human development.

Today teens in the U.S. and some other Westernized nations do display some signs of distress. The peak age for arrest in the U.S. for most crimes has long been 18; for some crimes, such as arson, the peak comes much earlier. On average, American parents and teens tend to be in conflict with one another 20 times a month--an extremely high figure indicative of great pain on both sides. An extensive study conducted in 2004 suggests that 18 is the peak age for depression among people 18 and older in this country. Drug use by teens, both legal and illegal, is clearly a problem here, and suicide is the third leading cause of death among U.S. teens. Prompted by a rash of deadly school shootings over the past decade, many American high schools now resemble prisons, with guards, metal detectors and video monitoring systems, and the high school dropout rate is nearly 50 percent among minorities in large U.S. cities.

But are such problems truly inevitable? If the turmoil-generating "teen brain" were a universal developmental phenomenon, we would presumably find turmoil of this kind around the world. Do we?

In 1991 anthropologist Alice Schlegel of the University of Arizona and Herbert Barry III, a psychologist at the University of Pittsburgh, reviewed research on teens in 186 preindustrial societies. Among the important conclusions they drew about these societies: about 60 percent had no word for "adolescence," teens spent almost all their time with adults, teens showed almost no signs of psychopathology, and antisocial behavior in young males was completely absent in more than half these cultures and extremely mild in cultures in which it did occur.

Even more significant, a series of long-term studies set in motion in the 1980s by anthropologists Beatrice Whiting and John Whiting of Harvard University suggests that teen trouble begins to appear in other cultures soon after the introduction of certain Western influences, especially Western-style schooling, television programs and movies. Delinquency was not an issue among the Inuit people of Victoria Island, Canada, for example, until TV arrived in 1980. By 1988 the Inuit had created their first permanent police station to try to cope with the new problem.

Consistent with these modern observations, many historians note that through most of recorded human history the teen years were a relatively peaceful time of transition to adulthood. Teens were not trying to break away from adults; rather they were learning to become adults. Some historians, such as Hugh Cunningham of the University of Kent in England and Marc Kleijwegt of the University of WisconsinMadison, author of Ancient Youth: The Ambiguity of Youth and the Absence of Adolescence in Greco-Roman Society (J. C. Gieben, 1991), suggest that the tumultuous period we call adolescence is a very recent phenomenon--not much more than a century old.

My own recent research, viewed in combination with many other studies from anthropology, psychology, sociology, history and other disciplines, suggests the turmoil we see among teens in the U.S. is the result of what I call the "artificial extension of childhood" past the onset of puberty. Over the past century, we have increasingly infantilized our young, treating older and older people as children while also isolating them from adults and passing laws to restrict their behavior [see box on next page]. Surveys I have conducted show that teens in the U.S. are subjected to more than 10 times as many restrictions as are mainstream adults, twice as many restrictions as active-duty U.S. Marines, and even twice as many restrictions as incarcerated felons. And research I conducted with Diane Dumas as part of her dissertation research at the California School of Professional Psychology shows a positive correlation between the extent to which teens are infantilized and the extent to which they display signs of psychopathology.

The headlines notwithstanding, there is no question that teen turmoil is not inevitable. It is a creation of modern culture, pure and simple--and so, it would appear, is the brain of the troubled teen.

Dissecting Brain Studies

A variety of recent research--most of it conducted using magnetic resonance imaging (MRI) technology--is said to show the existence of a teen brain. Studies by Beatriz Luna of the Laboratory of Neurocognitive Development at the University of Pittsburgh, for example, are said to show that teens use prefrontal cortical resources differently than adults do. Susan F. Tapert of the University of California, San Diego, found that for certain memory tasks, teens use smaller areas of the cortex than adults do. An electroencephalogram (EEG) study by Irwin Feinberg and his colleagues at the University of California, Davis, shows that delta-wave activity during sleep declines in the early teen years. Jay N. Giedd of the Child Psychiatry Branch at the National Institute of Mental Health and other researchers suggest that the decline in delta-wave activity might be related to synaptic pruning--a reduction in the number of interconnections among neurons.

This work seems to support the idea of the teen brain we see in the headlines until we realize two things. First, most of the brain changes that are observed during the teen years lie on a continuum of changes that take place over much of our lives. For example, a 1993 study by Jsus Pujol and his colleagues at the Autonomous University of Barcelona looked at changes in the corpus callosum--a massive structure that connects the two sides of the brain--over a two-year period with individuals between 11 and 61 years old. They found that although the rate of growth declined as people aged, this structure still grew by about 4 percent each year in people in their 40s (compared with a growth rate of 29 percent in their youngest subjects). Other studies, conducted by researchers such as Elizabeth Sowell of the University of California, Los Angeles, show that gray matter in the brain continues to disappear from childhood well into adulthood.

Second, I have not been able to find even a single study that establishes a causal relation between the properties of the brain being examined and the problems we see in teens. By their very nature, imaging studies are correlational, showing simply that activity in the brain is associated with certain behaviors or emotions. As we learn in elementary statistics courses, correlation does not even imply causation. In that sense, no imaging study could possibly identify the brain as a causal agent, no matter what areas of the brain were being observed.

Is it ever legitimate to say that human behavior is caused by brain anatomy or activity? In his 1998 book Blaming the Brain, Elliot S. Valenstein, now psychology professor emeritus at the University of Michigan at Ann Arbor, deftly points out that we make a serious error of logic when we blame almost any behavior on the brain--especially when drawing conclusions from brain-scanning studies. Without doubt, all behavior and emotion must somehow be reflected (or "encoded") in brain structure and activity; if someone is impulsive or lethargic or depressed, for example, his or her brain must be wired to reflect those behaviors. But that wiring (speaking loosely) is not necessarily the cause of that behavior or emotion.

Considerable research shows that a persons emotions and behaviors continuously change brain anatomy and physiology. Stress creates hypersensitivity in dopamine-producing neurons that persists even after they are removed from the brain. Enriched environments produce more neuronal connections. For that matter, meditation, diet, exercise, studying and virtually all other activities alter the brain, and a new study shows that smoking produces brain changes similar to those produced in animals given heroin, cocaine or other addictive drugs. So if teens are in turmoil, we will necessarily find some corresponding chemical, electrical or anatomical properties in the brain. But did the brain cause the turmoil, or did the turmoil alter the brain? Or did some other factors--such as the way our culture treats its teens--cause both the turmoil and the corresponding brain properties?

Unfortunately, news reports--and even the researchers themselves--often get carried away when interpreting brain studies. For instance, a 2004 study conducted by James Bjork and his colleagues at the National Institute on Alcohol Abuse and Alcoholism, at Stanford University and at the Catholic University of America was said in various media reports to have identified the biological roots of teen laziness. In the actual study, 12 young people (ages 12 to 17) and 12 somewhat older people (ages 22 to 28) were monitored with an MRI device while performing a simple task that could earn them money. They were told to press a button after a short anticipation period (about two seconds) following the brief display of a symbol on a small mirror in front of their eyes. Some symbols indicated that pressing the button would earn money, whereas others indicated that failing to respond would cost money. After the anticipation period, subjects had 0.25 second to react, after which time information was displayed to let them know whether they had won or lost.

Areas of the brain that are believed to be involved in motivation were scanned during this session. Teens and adults were found to perform equally well on the task, and brain activity differed somewhat in the two groups--at least during the anticipation period and when 5 (the maximum amount that could be earned) was on the line. Specifically, on those high-payment trials the average activity of neurons in the right nucleus accumbens--but not in other areas that were being monitored--was higher for adults than for teens. Because brain activity in the two groups did not differ in other brain areas or under other payment conditions, the researchers drew a very modest conclusion in their article: "These data indicate qualitative similarities overall in the brain regions recruited by incentive processing in healthy adolescents and adults."

But according to the Long Island, N.Y., newspaper Newsday, this study identified a "biological reason for teen laziness." Even more disturbing, lead author James Bjork said that his study "tells us that teenagers love stuff, but arent as willing to get off the couch to get it as adults are."

In fact, the study supports neither statement. If you truly wanted to know something about the brains of lazy teens, at the very least you would have to have some lazy teens in your study. None were identified as such in the Bjork study. Then you would have to compare the brains of those teens with the brains of industrious teens, as well as with the brains of both lazy and industrious adults. Most likely, you would then end up finding out how, on average, the brains in these four groups differed from one another. But even this type of analysis would not allow you to conclude that some teens are lazy "because" they have faulty brains. To find out why certain teens or certain adults are lazy (and, perforce, why they have brains that reflect their lazy tendencies), you would still have to look at genetic and environmental factors. A brain-scanning study can shed no light.

Valenstein blames the pharmaceutical industry for setting the stage for overinterpreting the results of brain studies such as Bjorks. The drug companies have a strong incentive to convince public policymakers, researchers, media professionals and the general public that faulty brains underlie all our problems--and, of course, that pharmaceuticals can fix those problems. Researchers, in turn, have a strong incentive to convince the public and various funding agencies that their research helps to "explain" important social phenomena.

The Truth about Teens

If teen chaos is not inevitable, and if such difficulty cannot legitimately be blamed on a faulty brain, just what is the truth about teens? The truth is that they are extraordinarily competent, even if they do not normally express that competence. Research I conducted with Dumas shows, for example, that teens are as competent or virtually as competent as adults across a wide range of adult abilities. And long-standing studies of intelligence, perceptual abilities and memory function show that teens are in many instances far superior to adults.

Visual acuity, for example, peaks around the time of puberty. "Incidental memory"--the kind of memory that occurs automatically, without any mnemonic effort, peaks at about age 12 and declines through life. By the time we are in our 60s, we remember relatively little incidentally, which is one reason many older people have trouble mastering new technologies. In the 1940s pioneering intelligence researchers J. C. Raven and David Wechsler, relying on radically different kinds of intelligence tests, each showed that raw scores on intelligence tests peak between ages 13 and 15 and decline after that throughout life. Although verbal expertise and some forms of judgment can remain strong throughout life, the extraordinary cognitive abilities of teens, and especially their ability to learn new things rapidly, are beyond question. And whereas brain size is not necessarily a good indication of processing ability, it is notable that recent scanning data collected by Eric Courchesne and his colleagues at the University of California, San Diego, show that brain volume peaks at about age 14. By the time we are 70 years old, our brain has shrunk to the size it had been when we were about three.

Findings of this kind make ample sense when you think about teenagers from an evolutionary perspective. Mammals bear their young shortly after puberty, and until very recently so have members of our species, Homo sapiens. No matter how they appear or perform, teens must be incredibly capable, or it is doubtful the human race could even exist.

Today, with teens trapped in the frivolous world of peer culture, they learn virtually everything they know from one another rather than from the people they are about to become. Isolated from adults and wrongly treated like children, it is no wonder that some teens behave, by adult standards, recklessly or irresponsibly. Almost without exception, the reckless and irresponsible behavior we see is the teens way of declaring his or her adulthood or, through pregnancy or the commission of serious crime, of instantly becoming an adult under the law. Fortunately, we also know from extensive research both in the U.S. and elsewhere that when we treat teens like adults, they almost immediately rise to the challenge.

We need to replace the myth of the immature teen brain with a frank look at capable and savvy teens in history, at teens in other cultures and at the truly extraordinary potential of our own young people today.

(The Author)

ROBERT EPSTEIN is a contributing editor for Scientific American Mind and the former editor in chief of Psychology Today. He received his Ph.D. in psychology from Harvard University and is a longtime researcher and professor. His latest book is called The Case against Adolescence: Rediscovering the Adult in Every Teen (Quill Driver Books, 2007). More information is at www.thecaseagainstadolescence.com

(Further Reading)

Blaming the Brain: The Truth about Drugs and Mental Health. Elliot S. Valenstein. Free Press, 1998.

The End of Adolescence. Philip Graham. Oxford University Press, 2004.

Wednesday, November 18, 2015

Confirmation Bias

Sunday, November 15, 2015

Andy grove and CEOs

Later, in 2001, I met with Andy again and I asked him about a recent run of CEOs missing their numbers despite having told investors that their businesses were strong. The bubble had burst for the first wave of Internet companies nearly a year prior, so it surprised me that so many many of them had not seen this coming. Andy replied with an answer that I did not expect: "CEOs always act on leading indicators of good news, but only act on lagging indicators of bad news."

"Why?" I asked him. He answered in the style resonant of his entire book: "In order to build anything great, you have to be an optimist, because by definition you are trying to do something that most people would consider impossible. Optimists most certainly do not listen to leading indicators of bad news

Saturday, November 14, 2015

Durges Shah

Read more at: http://www.moneycontrol.com/news/market-outlook/why-durgesh-shah-believes-knowledge-is-over-ratedmkts_3953801-1.html?utm_source=ref_article

Thursday, November 5, 2015

Baupost

A letter gives a rare glimpse into one of the world's most secretive — and most successful — hedge funds

(Getty Images/ Scott Olson)

There are two types of investing, according to the departing partner of hugely successful and secretive hedge fund Baupost Group: "needle in a haystack investing" and "tide comes in and tide goes out investing."

One type takes rigorous work as you search for a small number of opportunities. The other, "chutzpah."

The partner, Brian Spector, made those comments in a letter to investors in the $27 billion hedge fund.

The letter, included with Baupost's quarterly update, provides a rare glimpse into the Boston-based fund, which is led by iconic value investor Seth Klarman.

Spector, a senior member of the fund's public investment group, will retire at the end of the year after 17 years at the fund to focus on his family and philanthropy, according to the third-quarter update, dated October 15 and obtained by Business Insider.

Klarman, the author of the famed book on value investing "Margin of Safety," described Spector as "an outstanding investor, collaborator, and mentor."

Klarman also asked Spector to write directly to investors.

"Because of his unique perspective and insights, I asked Brian to draft a letter to you that accompanies this letter. He alone determined the content. I hope you find that it furthers your understanding of Baupost," Klarman wrote.

As of the end of last year, Baupost Group had achieved net gains (after fees) of $23.4 billion since its inception in 1982, placing it amongst the top-performing funds in the world, according to data from LCH Investments.

In more than three decades, it has had only two down years. Right now, the fund is on track for its third annual loss, suffering a "mid-single-digit year-to-date decline" after what Klarman described as a "painful" third quarter.

Dot-com bubble

Spector was 25 when he joined Baupost in May 1998 during the "heart" of the dot-com bubble. It was a tough time to be a value investor — broadly defined as finding stocks that are undervalued by the market and poised to rise.

Back then, some thought that the glory days of value investing had passed.

"Traditional metrics like cash flow and asset values were being blatantly disregarded by the market in favor of newfound metrics such as eyeballs and clicks. High-tech companies were the darlings in a rapidly rising market while less-sexy value stocks significantly lagged," Spector wrote in the letter.

Baupost finished the year down over 12%.

Two years later, though, the dot-com bubble burst, presenting an opportunity for Baupost.

While others were selling off their positions, Baupost continued to buy tech stocks at "remarkable prices."

It wasn't easy. Spector wrote that there were many sleepless nights watching investments they made at bargain prices continue to fall:

The bear market picked up steam and we found a number of stocks trading near or even below their net cash value. We bought baskets of formerly hot technology stocks that were getting pummeled, despite having good businesses with contracted revenues. Although many of these companies were experiencing negative cash flow, their management teams were shrinking headcount to align to the new economic reality and were successfully lowering or eliminating cash burn. It seemed like shooting fish in a barrel. We were buying cash at a discount with an option that the underlying businesses had real value. All we had to do was wait for that underlying value to be recognized. What could be easier than buying cash at a discount?

It turns out buying a dollar for 50 cents is a lot harder than it seems. Every day we added to these positions, thinking we were getting an even better bargain than the day before, only to wake up and watch prices drop further. Other respected investors would often comment about how 'value tech' was a 'value trap,' best to be avoided. It was as if the market was having a 'going out of business' sale and we happened to be the only customer who showed up. While both exhilarating and painful at the same time, what I remember most vividly is exhaustion. After countless late nights at the office, I would head home, collapse on my couch and stare at the ceiling. I was unable to read, watch television, or fall asleep. All I could do was worry about what we might have missed in our analysis.

Ultimately, Baupost was right in its thesis. The market turned, and the stocks they had bought shot up.

What's more, moments like that don't come up too often in the market. It was a "tide comes in and tide goes out" opportunity.

"Most of the time we are in periods of haystack investing," he explained. "We sift through lots of investment ideas to find a few decent opportunities. We sell more securities than we buy and our cash reserves begin to build."

Then, once or twice a decade, the markets "become significantly dislocated" and the tides change. That's when it's time to get in, and it takes nerve.

From the letter:

We see distressed sellers, illiquid securities, huge redemptions, and an excess of paranoia and fear. We quickly find a number of interesting opportunities, deploying our significant cash balances as we trade our precious liquidity for mispriced securities. We may lose money in the short term, as we add to our portfolio while prices are dropping. But when markets turn, we expect multiple years of strong profitability.

Investing in tide markets takes chutzpah. To do so effectively, you need to fly in the face of public opinion, you have to fight normal human emotions, and you have to be prepared to double down on your bets when your conviction is most in question. As Benjamin Graham once said, 'The investor's chief problem and even his worst enemy is likely to be himself.' But most importantly, you have to be at a place that empowers you to succeed—a place that is uniquely situated to take advantage of these market conditions. A place like Baupost.

A typical day at Baupost involves the team sifting through possible investment ideas:

On most days, it offers a menu full of bland, unhealthy, and fully-priced choices. We do enough work on the offerings to make sure we aren't missing anything and often go home feeling unsatisfied and unproductive.

Then, they find something that's compelling and focus their energy on it:

We work furiously to understand the drivers of the investment. We spend an enormous amount of time focused on the downside and the risk of permanent capital loss. We also try to understand potential optionality and upside. We ask ourselves, 'How and when will the market eventually see the situation differently?' Once we have a hypothesis about why an investment may be interesting, we start down the path of trying to confirm or reject our original thesis. Depending on complexity and price, this process may take days, weeks, or even months. Oftentimes we place investment ideas back on the shelf and wait for a lower price. Only when the investing stars line up will we add the position to our portfolio.

We can do this successfully because we have a culture of patience. Even though we work hard every day trying to uncover the next great investment, we only deploy our capital when we have real conviction that we have found one. When we don't find interesting ideas, we do nothing and hold cash. For this reason, I've often joked that I'm 97% unproductive. While this means I better be damn productive the other 3% of the time, it also means exercising patience often and waiting for great opportunities. On the flip side, when an idea has been analyzed and is fully baked, we drop whatever else we are doing, discuss the investment, and make a decision. Our portfolio decision process must be incredibly efficient, as we recognize that good ideas are scarce and may prove fleeting.

Warren Buffett said, 'Big opportunities come infrequently. When it's raining gold, reach for a bucket, not a thimble.' When a great opportunity comes around, it is imperative to size it correctly.

One key reason the fund is able to invest in those big ideas is it keeps cash on hand:

One of the most common misconceptions regarding Baupost is that most outsiders think we have generated good risk-adjusted returns despite holding cash. Most insiders, on the other hand, believe we have generated those returns BECAUSE of that cash. Without that cash, it would be impossible to deploy capital when we enter a tide market and great opportunities become widespread. Seth has said on a number of occasions in both types of markets, 'If you have great ideas, you will have capital to deploy.' This is incredibly motivating to our investment team.

Aside from discussing how the firm uses the fundamentals of value investing, Spector also delved into the culture of Baupost. Unlike some funds where the environment is super competitive, Spector said that Baupost has a culture revolving around teamwork and confidence in one another.

When a team member finds a good idea, we discuss who should work on it and how it compares to other ideas we are currently finding (as well as other past ideas). This is a complicated management issue. Good ideas are scarce and most investors like to pursue investments they have sourced. At most investment firms, analysts operate as free agents. Their pay is based primarily on the performance of their individual "book." Rather than cooperating and maximizing investment returns for the firm, they are often incentivized to do the converse. This may breed a culture of mistrust and misplaced motivations.

At Baupost, it is just the opposite. This is an area that I believe makes Baupost exceptional and can't be fully understood from the outside. People work together to maximize the returns for our clients, partly because they are incentivized to do so, but also because they believe in one another. No one would want to hand off a good idea and watch another analyst drop the ball. But, since our investment staff is accountable to both the partners and the team, they comfortably make hand-offs, root for one another, and try to help in any way possible. This means reviewing investments, exchanging impactful information and opinions, as well as mentoring one another.

It is a running joke in our industry that portfolio managers look enviously at the teams of their competitors, always assuming the other groups are better. Not here. At Baupost, I've never thought that I would want to go into 'investment battle' with anyone else. Our team is excellent and I believe it has improved as we have grown. (Quite frankly, I wonder if I would even have the opportunity to interview at today's Baupost!) We get along, share ideas, support one another, mentor younger analysts, and have a good time together. I know the part I will miss most about Baupost is the daily interaction with my smart, ethical, hard-working, and funny (some intentionally) colleagues.

He noted that you'd never know what the market is doing based on the atmosphere of the fund's trading floor:

We try to maintain a calm working environment. In order to really understand a firm and its decision-making process, one needs to comprehend how it acts in a period of uncertainty and stress. Are people calm or yelling at each other? Does it feel like business as usual or is everyone paralyzed by all the red on their screens? At Baupost, if you were in our trading room, you would not know if the market was up 5% or down 5%. This is by design. It is much easier to make reasoned decisions without someone screaming at you or second guessing your judgment. It's not always easy, but we try to maintain the same atmosphere and investment process in all markets.

Spector concluded that Baupost's successful long-term track record isn't due to a "silver bullet" of "formula," but rather the 215 people who make up the firm.

NOW WATCH: Tony Robbins reveals the very first investment everyone should make

Monday, November 2, 2015

Chetan Parikh - ISB value investing summit

“Sigmoid”, I think it is important to be on the sharp upside of the sigmoid curve. It’s about getting in early in a large market opportunity. In my case, I must hasten to add, in most stocks where I have ridden the sigmoid curve up, it has been largely through luck.

"Practiced deconstruction: - If you have ever listened to someone explain a book, a movie, or even a magazine article and you wanted to interrupt and say “But I saw something that contradicts what you are saying”, than you have practiced deconstruction

Here's How Isaac Newton Remembered Everything He Read The scientific genius had very specific habits when he pored over books in his favorite library

- Samuel Foster's Miscellanies: or, Mathematical Lucubrations (1659)

- A treatise on numismatics from 1700

- A 1610 Basle edition of the Artis Auriferae, a collection of tracts dealing with alchemy

- Heinrich Cornelius Agrippa's De Occulta Philosophia (1533), which was about occult philosophy and ritual magic.

Newton dog-eared pages in a very specific way.

Newton took extensive notes in the book itself.

Newton was exceptionally organized as a note taker.

Newton wasn't afraid to damage the books.

Saturday, October 24, 2015

100-baggers since 1962... [feedly]

----

100-baggers since 1962...

// Value Investing World

Some interesting stats and thoughts from Chris Mayer in his book 100 Baggers: Stocks That Return 100-to-1 and How To Find Them:

There are 365 stocks that have met our 100-bagger threshold since 1962.

The 100-bagger population seems to favor no particular industry. There are retailers, beverage makers, food processors, tech firms and many other kinds. The only thing they seem to have in common is the subject of the study: they returned at least 100 to 1.

It's also worth considering the size of these companies when they started their march. Now I hesitate to make generalizations from the statistics, as I've said. And that's why my focus is more on anecdotal evidence and the ideas or theories behind 100-baggers. With that warning, I'll add that the median sales figure for the 365 names at the start was about $170 million and the median market cap was about $500 million.

That's interesting on two levels: One, it dispels a myth that to get a 100-bagger you have to start with tiny companies. True, these are small companies. But $170 million in sales is a substantial business in any era. It's not a tiny 50-cent stock with no revenues or barely any revenues.

Secondly, these figures imply a median price-to-sales ratio of nearly three, which isn't classically cheap by any measure. Going through these 100-baggers, you'll find stocks that looked cheap, but more often you find stocks that did not seem cheap based on past results alone.

So you must look forward to find 100-baggers. You have to train your mind to look for ideas that could be big, to think about the size of a company now versus what it could be. This doesn't mean you have to have a huge market to address, although that helps. Even a small company can become a 100-bagger by dominating a niche. Polaris was a 100-bagger and makes snowmobiles.

Despite occasional exceptions, you do want to focus on companies that have national or international markets. Far more common than niche companies on the 100-bagger list are companies such as Comcast, Aflac, Dollar General, ADP and Lockheed Martin. These companies came to dominate big spaces, though they all started small.

In 1982, Aflac had just $585 million in sales. By 2002, by which time it was a 100-bagger, Aflac had sales of $10.2 billion. Aflac's price-to-sales ratio, by the way, went from about 1.7 to 5.4. So, you had the twin engines: sales growth and multiple growth. Sales went up roughly 17-fold and the price-to-sales ratio went up roughly 3-fold. In combination, and including reinvested dividends, they worked the stock up a hundredfold. Even if we exclude the dividends, Aflac became a 100-bagger two years later, in 2004.

Another interesting chart to look at concerns how long these stocks took to become 100-baggers. The average time was 26 years. That was also the median.

----

Shared via my feedly reader

Thursday, October 1, 2015

Tolstoy and Gandhi

And now it seems we are subjugating ourselves to bigger Ruler, the One and only and taking lives in His name!

Monday, September 28, 2015

Practicing Mind

I found that, when given my present moment attention, the practice sessions were very calming, not bothersome. I didn't have to be anywhere but “here,” and I didn't have to accomplish anything but exactly what I was doing “right now.” I found that immersing myself in the process of practicing would shut off all the tensions of the day and all the thoughts of what had to get done “tomorrow.”

We erroneously think that there is a magical point that we are going to get to and then we will be happy. We look at the process of getting there as almost a necessary nuisance we have to go through in order to get to our goal.When you focus on the process, the intended product takes care of itself with fluid ease.

When, instead, your "goal" is focusing on the process or staying in the present, then there are no mistakes and no judging.

Back in the mid-seventies there was a real upheaval going on in the business world of manufacturing. Everyone wanted a Japanese automobile because they were noticeably higher in quality. American auto manufacturers were scrambling to understand why this was and how to fix it. But this wasn't a situation localized in the auto industry. Japanese pianos were becoming popular in this country. Some of them had names people had never heard of and couldn't even pronounce properly, but they could see the quality difference in them regardless.

Sunday, September 27, 2015

Dhandho

- Score keeping is Mr. Pabrai’s most important lesson to achieve success in life and investing. Especially, the track-record is important in investing and gaming. It can help you to track your mistakes and improve your knowledge.

- Has read the Poor Charlies Almanac 7 times and still finds new insights.

- Self-improvement is the most important thing, he would bet on the guy with less knowledge and less skills if he has a drive to self-improvement, over a lifetime he will bet the guy with more skills.

- Pabrai thinks that Fiat is highly undervalued. Minimum margin of safety is 50% and it has the potential to become a +4x. The spinoff of Ferrari will come in less than a month and it is still not considered in the share price.

- Pabrai currently holds: Fiat 42% of the fund , GM B Warrents >10% , POSCO ~10% , ~15% Horsehead Holding , ~10% Google

- Dhando Holding IPO will be delayed by 2-3 years, they are currently developing a Smart-Beta value ETF and an own direct small businesses Insurance company (GEICO for businesses)

- Stone Trust made an underwriting loss of 4 million this year (when the Equity was just 61 million)

Start of the presentation

‘Post-mortem’

Sold Bank of America

Sold Citi

Dhandho –Holdings

- A GEIGO for small business via internet

- A smart-Beta ETF

Sunday, September 20, 2015

Anger

The Parable of the empty boat. 🌺⛵

A monk decides to meditate alone, away from his monastery. He takes his boat out to the middle of the lake, moors it there, closes his eyes and begins his meditation. After a few hours of undisturbed silence, he suddenly feels the bump of another boat colliding with his own. With his eyes still closed, he senses his anger rising, and by the time he opens his eyes, he is ready to scream at the boatman who dared disturb his meditation.

But when he opens his eyes, he sees it's an empty boat that had probably got untethered and floated to the middle of the lake.

At that moment, the monk achieves self-realization, and understands that the anger is within him; it merely needs the bump of an external object to provoke it out of him.

From then on, whenever he comes across someone who irritates him or provokes him to anger, he reminds himself, "The other person is merely an empty boat. The anger is within me."

🙏👍

Tuesday, September 15, 2015

Cash

A man is rich in proportion to the number of things he can afford to let alone.

Henry David Thoreau

Just because the market is open does not mean you have to trade. Cash is a position too.

Friday, September 4, 2015

What QE Actually Impacted [feedly]

What QE Actually Impacted by Eric Bush, CFA, Gavekal Capital Blog

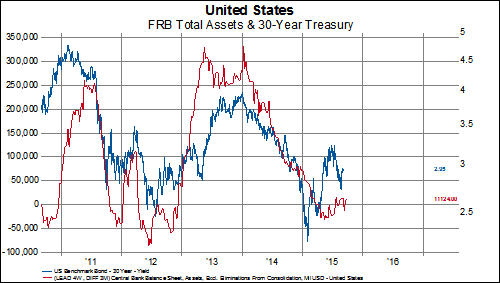

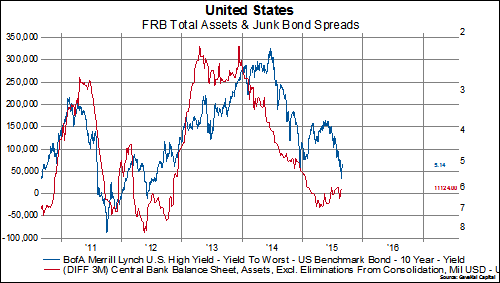

The Federal Reserve's balance sheet has now been relatively unchanged for about 10 months. Total asset at the Fed are about $61 billion higher than they were one year ago. It sounds like a lot but considering total assets are currently $4.48 trillion, $61 billion is a drop in the bucket.

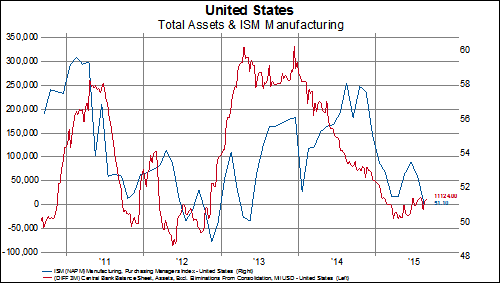

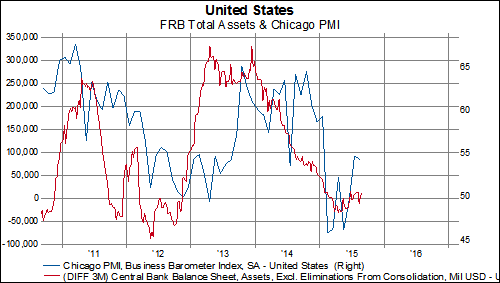

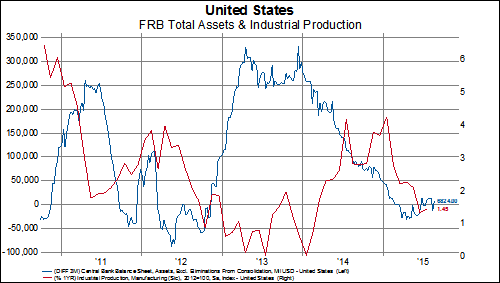

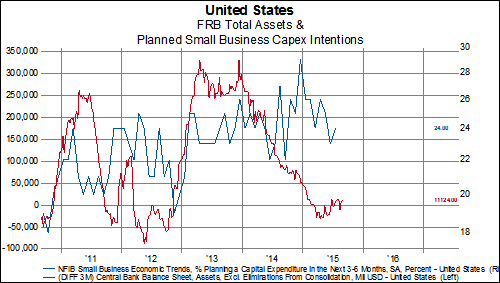

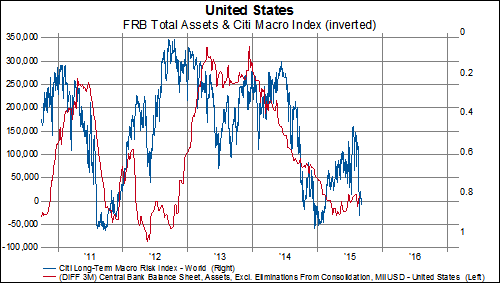

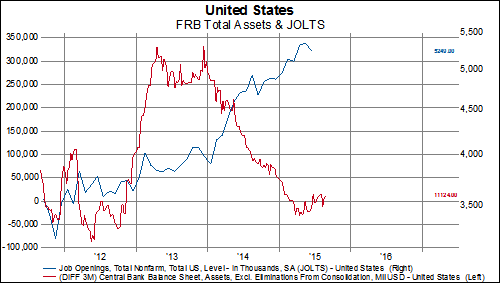

During the various QE programs in the US, a useful template to track different market and economic indicators was to plot them against the 3-month change in total Fed assets (see some of our older posts here, here, and here). Now that we have gone nearly a year since the taper ended, let's check in on some relationships.

QE certainly affected asset prices. For government bonds, yields widened as the Fed's balance sheet expanded and have narrowed as the Fed's balance sheet has stopped growing. For corporate bonds, spreads over treasury narrowed as the Fed was expanding its balance sheet and have since widened substantially as the Fed's balance sheet has stopped expanding. Breakeven inflation expectations have dropped significantly as the Fed's balance sheet has stopped growing as well.

Stocks were positively affected as well. The 12-month change in the S&P 500 has fairly closely tracked the 3-month change in Fed assets. Momentum in the market has also tracked the change in Fed assets.

The effect on economic indicators is much more mixed. QE seems to have clearly impacted the manufacturing PMIs. However, the effect on manufacturing IP itself is tougher to discern.

It's tough to see if QE had much effect on house prices. And it certainly didn't matter to the consumer or small business owners. However, it seems to have negatively impacted economic surprises and increased perceived macro risks in the world as it was winding down.

Finally, QE didn't seem to make much of a difference for nominal GDP or employment.

Unfortunately, overall it seems that QE had a much larger impact on bond and stock prices than on real economic activity. Government bond yields widened when the Fed was expanding its balance sheet while corporate spreads over bond yields narrowed. Stock prices were positively impacted by QE as well and have lost a lot of momentum since QE ended. Manufacturing surveys, in the US and globally, have been affected by QE but real economic indicators such as employment, small business intentions, and GDP have shown little relationship to changes in the Fed's balance sheet level.

The post What QE Actually Impacted appeared first on ValueWalk.

Sent from my iPad